Homeowner Resources

Are you thinking about going solar? Check out the following pages to learn more about the mechanics of solar energy and how you, too, can power your home or business with the sun! Then when you're ready find an installer in your area!

How Solar Works

This

page explains how the energy from the sun gets converted into something

you can use in your home! Both solar photovoltaic systems and solar thermal systems

are covered.

Powering Your Home With The Sun

These presentation slides from ISEA Solar Ambassadors serve as an overview of how solar works, steps to going solar, and exciting things happening in Illinois due to new legislation. Click here to learn more, watch a recording of a past presentation, and view presentations on some other related topics. You can find dates for future presentations on ISEA's calendar.

The Installation Process

Getting

started on the installation process can sometimes seem overwhelming!

This page breaks it down step-by-step, from site assessment to

financing.

How to Choose a Qualified Installer

Unsure what company you should choose to safely install and connect your system? Follow this guide!

Renewable Energy Credits and Pricing

Learn about the incentives for going solar, and what you can expect to earn back.

Illinois Shines State Incentive Program

Customers looking to better understand the process and timeline for participating in the Illinois Shines program can now refer to the “Going Solar: Your Guide to Illinois Shines” flyer. The Going Solar flyer is designed to explain the steps and timeline for participation in the Illinois Shines Program. The flyer breaks down the process into seven steps while seeking to avoid technical or industry jargon. Customers are encouraged to review this resource, so they know what to expect when participating in the Illinois Shines Program.

Additionally, the project status lookup tool is another resource that customers can use to determine the status of their application in the process.

Net Metering & Interconnection FAQs

ComEd residential customers are eligible to participate in Net Metering if they own or operate an eligible system less than or equal to 2,000kW (AC-rated) for their own use. Ameren residential customers can participate in Net Metering with any size system.

As of January 1st, 2025, new solar customers will receive net metering for their supply charges, but NOT for their delivery charges or taxes/fees as they have in the past. Customers will be able to choose between a 1:1 kWh or monetary credit for excess electricity exported to the grid, applied to their next bill if exports exceed consumption. These credits will not expire.

To offset the initial cost to install solar and/or storage, customers can apply for a one-time “Distributed Generation (DG) Rebate” (also called the “Smart Inverter Rebate”) and/or the “Storage Rebate.” The DG Rebate offers an incentive of $300 per kilowatt of generating capacity and the Storage Rebate offers an incentive of $300 per kilowatt hour of storage. A customer must participate in a peak time rebate program, hourly pricing program or time of use rate program offered by their utility to qualify for the Storage Rebate.

Solar customers who installed their system BEFORE January 1, 2025 will receive full retail net metering, which includes for supply charges, delivery charges, and taxes/fees. This is legacy net metering.

Legacy customers will receive legacy net metering for the whole lifetime of the system, but the credits will zero out once a year, in either April or October.

Legacy customers in ComEd territory may expand their systems with no cap and still retain legacy net metering. Legacy customers in Ameren territory may expand their systems with a cap at 100% and still retain legacy net metering.

Learn more on the Solar Powers Illinois Net Metering Landing Page!

Solar systems should not increase your property taxes. Illinois offers a special assessment for solar energy systems, but you may have to register with a chief county assessment officer or contact your local assessor. Solar energy equipment is valued at no more than a conventional energy system. Click the above link to learn more, view the tax code language, and download the necessary forms.

Homeowners' Energy Policy Statement Act Amendments

First passed as the Illinois Solar Rights Act in 2011 and amended in 2021 as the Homeowners' Energy Policy Statement Act, these amendments make it easier for people in HOAs to go solar. Changes the definition of "solar storage mechanism" to include batteries. Provides that the entity may determine the specific configuration of the elements of a solar energy system on a given roof face, provided that it may not prohibit elements of the system from being installed on any roof face and that any such determination may not reduce the production of the solar energy system by more than 10% (rather than specific location where a solar energy system may be installed on the roof within an orientation to the south or within 45 degrees east or west of due south provided that the determination does not impair the effective operation of the solar energy system). Provides that within 90 (rather than 120) days after a homeowners' association, common interest community association, or condominium unit owners' association receives a request for a policy statement or an application from an association member, the association shall adopt an energy policy statement. Provides that whenever approval is required for the installation or use of a solar energy system, the application for approval shall be processed by the appropriate approving entity of the association within 75 (rather than 90) days of (rather than after) the submission of the application. Provides that the Act shall not apply to any building that is greater than 60 (rather than 30) feet high, or to any building that has a shared roof and is subject to a homeowners' association, common interest community association, or condominium unit owners' association.

Investment Tax Credit (ITC)

There are two federal tax credits that incentivize solar investments: (1) the Section 48 Investment Tax Credit (ITC) available to businesses who invest in solar energy systems; and (2) the Section 25D residential solar energy credit that may only be claimed by individuals who purchase a solar energy system, typically installed on the roof of their home.

UPDATE: As of July 2025, the ITC for residential solar will end on January 1st, 2026.

DSIRE ILLINOIS Incentives/Policies for Renewables & Efficiency

Learn more about incentives you can take advantage of as a user and producer of solar energy.

Further questions about incentives? Visit ipa.illinois.gov/renewable-resources.html and illinoisshines.com to learn about updates as they happen

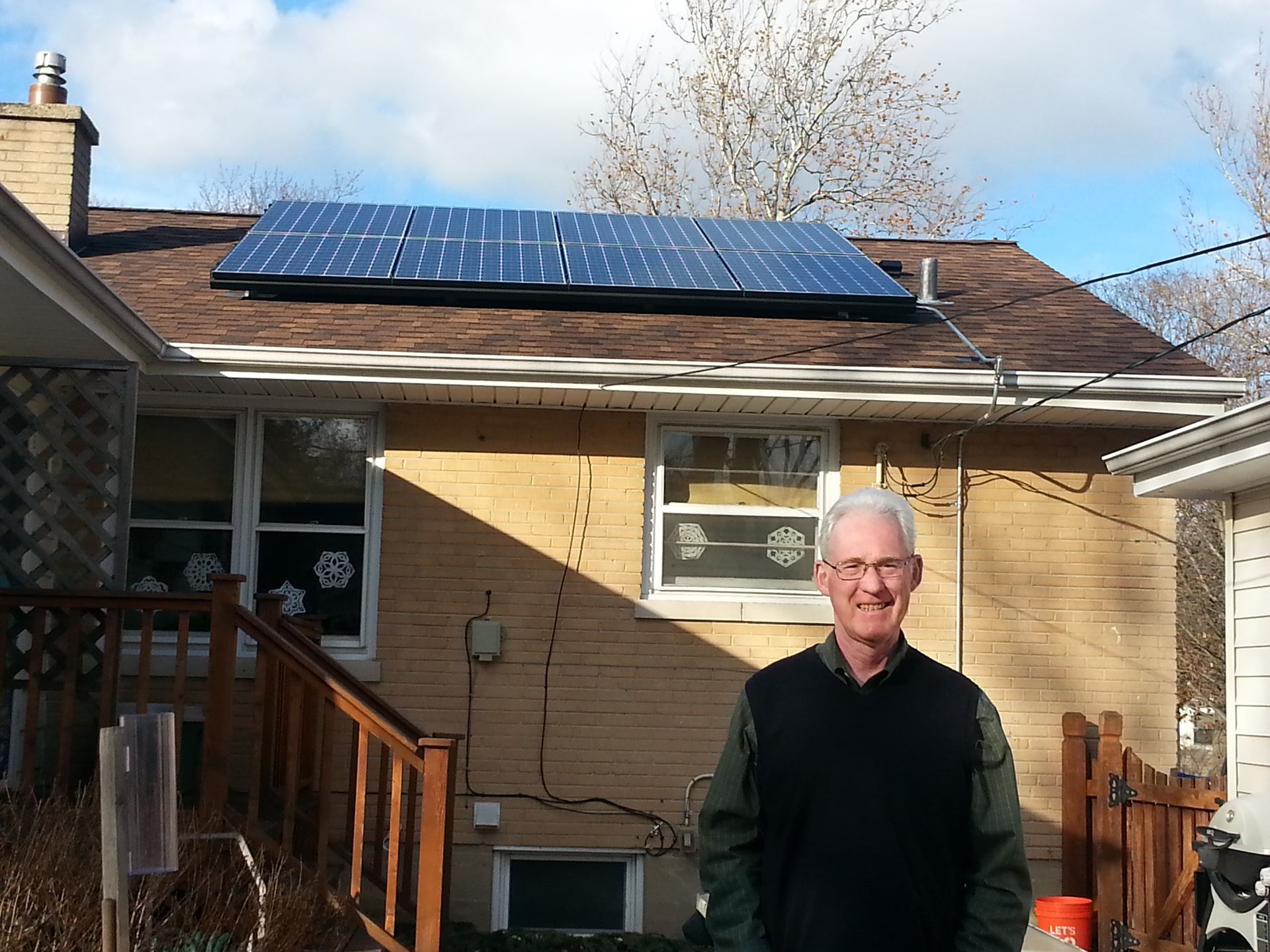

Interested in talking with someone who already has solar on their home or business? ISEA's Solar Ambassadors are happy to talk about their experiences and give advice to those interested in going solar! Visit our Solar Ambassador page here.